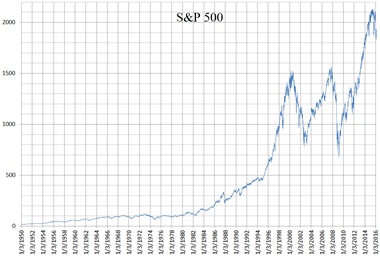

Investing is a good strategy to grow your wealth over time. Especially when it comes to long-term investing, the stock market is difficult to beat when it comes to yearly returns. Economic downturns come and go, but overall the market always recovers and grows. This becomes evident when looking at numerous indices, such as the S&P 500 which comprises 500 US-based large companies across industries. Next to that, depending on the stocks you select, you also enjoy dividend pay-outs that help you grow your wealth.

Monitoring your wealth

You can keep an up-to-date overview of all your holdings by leveraging a stock market tracker. This is a piece of software or app that allows you to track the prices of stocks you own in real-time in that market.

Biases in tracking investments

Do watch out for biases that could arise when using a stock market tracker. Monitoring could lead you to try to predict the market based on the daily fluctuations. However, as a rule of thumb, it is better to invest periodically with a fixed amount to spread the risk. A selection of typical biases that could arise are:

- Loss aversion

- Overconfidence

- Regret

All of them are relevant when using a stock market tracker. For example, if you sell a stock and continue to track its progress you can easily move in ‘regret’ mode. Often, investors then buy back the share at a higher price, which is undesirable and could lead to a lower return on investment (ROI).

The crypto portfolio tracker is on the rise as well

Next to traditional investing, we see a rise in crypto investing. This follows different patterns and does require investors to monitor their holdings frequently. Having a crypto portfolio tracker could help you to monitor all your crypto holdings across brokers and wallets you possess. However, looking at the price developments of Bitcoin, it could have been better to watch a little less often and ‘hold’ your way to new heights.

How new technologies are enabling traders across the globe

Stock markets went through cycles of innovation, with the rise of Financial Technology (FinTech) being the most recent example. The emergence of this technology also resulted in new regulations, such as PSD2. This requires banks active in the European Union to open up their systems to talk to other systems as the end-customer desires. This is an answer to the rise of API-based software that can talk to other systems and share data based on predefined standards.

Stock market trackers are starting to leverage this

The ‘open network’ of systems is now being leveraged by trackers. For example, you can connect different broker accounts to your tracker and have full insight into your portfolio without any manual input needed. Next to that, some trackers even allow you to directly trade through the tracker on the broker platforms. This makes it possible to compare transaction fees and select the broker that is most attractive for a specific stock (market).